The broker needs to develop strategies to recognize and avoid problems that might occur instead of dealing with them after they occur.

By Jeff Sorg, OnlineEd Blog

(June 27, 2019) (September 15, 2020)

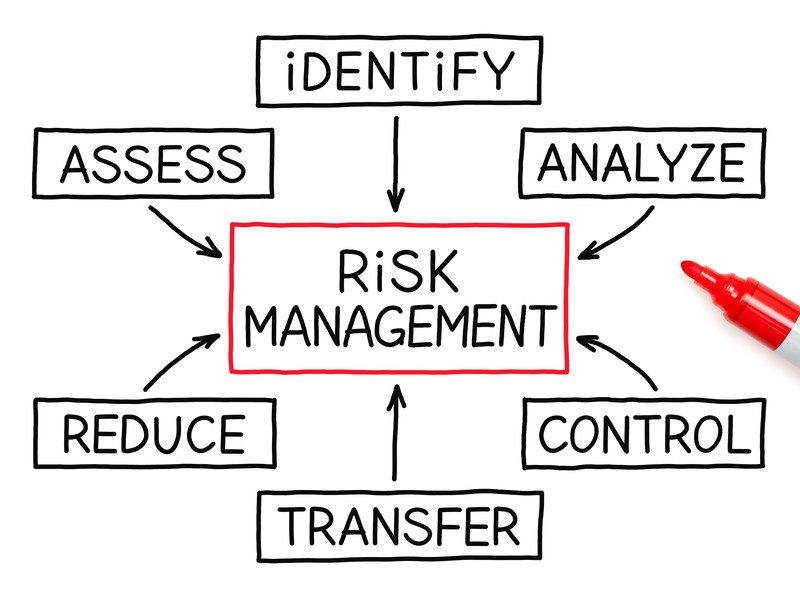

(PORTLAND, Ore.) OnlineEd – Risk anticipation for the real estate broker relies on the ability to identify problems that might eventually happen with a client or transaction. The broker needs to establish some strategies early on in their career to help recognize and avoid situations that might occur, instead of trying to deal with them after they occur.

(PORTLAND, Ore.) OnlineEd – Risk anticipation for the real estate broker relies on the ability to identify problems that might eventually happen with a client or transaction. The broker needs to establish some strategies early on in their career to help recognize and avoid situations that might occur, instead of trying to deal with them after they occur.

Some examples of risk anticipation and strategies to prevent risk are:

- documentation and recordkeeping;

- disclosures;

- disclaimers; and

- documentation of information provided to and from the client.

Documentation and Recordkeeping

Good recordkeeping and transaction documentation practices are essential to managing and minimizing risk. When a transaction problem happens, the broker will likely be asked to explain which actions were or were not taken to either cause or correct the problem, as well as to justify their actions.

As time passes, detailed memories about a transaction or event can become unreliable — or sometimes be altogether forgotten. Having written observations created at the time an event occurred will mostly be regarded as reliable evidence. In fact, in the case of litigation, contemporaneous memoranda are often accepted as an accurate record of events.

DEFINITION: Contemporaneous memorandum or documentation – a note written at the time of an event and stored in the transaction or client file.

Brokers should keep a file for each transaction or significant client event. Because it is difficult to anticipate problems that might arise in the future, proper documentation of any action taken at the time an event happens is always an excellent first line of defense against liability.

Here are some suggestions for real estate brokers to develop defensive recordkeeping practices and procedures:

- Document all sources of information received.

- Keep a phone log that summarizes all business calls.

- Save all email and text communications.

- Keep a complete transaction file that includes documentation of disclosures and disclaimers.

- Keep dated records of the types of housing each prospective buyer asked to view, the kinds of housing options offered (manufactured, single-family, condominiums, etc.), and other services provided.

- Send the seller written updates about property showing activity and the feedback.

- Indicate on each correspondence everyone who is receiving copies.

- Use confirmation letters to shift the burden of responsibility to the other party (“put the ball in their court”).

Disclosures – Be aware of and make all of your required disclosures promptly. These disclosures include the agency disclosure, conflicts of interest disclosure, seller’s property disclosure, environmental hazards disclosure, and others required by local law.

Disclaimers – While qualified to advise clients about selling and buying real estate, matters sometimes arise that will be outside of your area of expertise or beyond the scope of your real estate license. In these cases, you will want to use a written disclaimer to advise the client to seek the advice of a competent professional or service.

Documenting Information Provided To of From a Seller or Buyer – Your client might provide you with certain information or documents. Documents and information given to you by the client should be kept in your client file for future verification of the information or documents. You should also maintain a record of who asks for these verifications.

Risk Control – As soon as a liability issue is identified, steps should be taken to control it. Of primary importance is dealing with any complaint before it turns into litigation. Dealing with the complaint often means simple communication with the complaining party to try to minimize the issue or let them know you might be able to find an acceptable solution to the concern. Usually, failure to handle a complaint in its early stages will allow it to take on a life of its own. Quickly dealing with a complaint can prevent the complaining party from becoming angry and uncooperative, so be sure to address complaints promptly and before any opportunity for settlement becomes unlikely. Risk control means addressing an issue when it first arises by attempting to find an agreeable solution as soon as possible. While a resolution or settlement may seem expensive, a settlement made where liability is likely to exist can be cheaper than litigation. Even if you win the litigation, your legal fees and costs to achieve the win will usually exceed a settlement amount agreed to before the litigation.

###

OnlineEd blog postings are the opinion of the author and not intended as legal or other professional advice. Be sure to consult the appropriate party when professional advice is needed.

For more information about OnlineEd and their education for real estate brokers, principal brokers, property managers, and mortgage brokers, visit www.OnlineEd.com.

All information contained in this posting is deemed correct as of the date of publication, but is not guaranteed by the author and may have been obtained from third-party sources. Due to the fluid nature of the subject matter, regulations, requirements and laws, prices and all other information may or may not be correct in the future and should be verified if cited, shared, or otherwise republished.

OnlineEd® is a registered Trademark